By María José Gamba

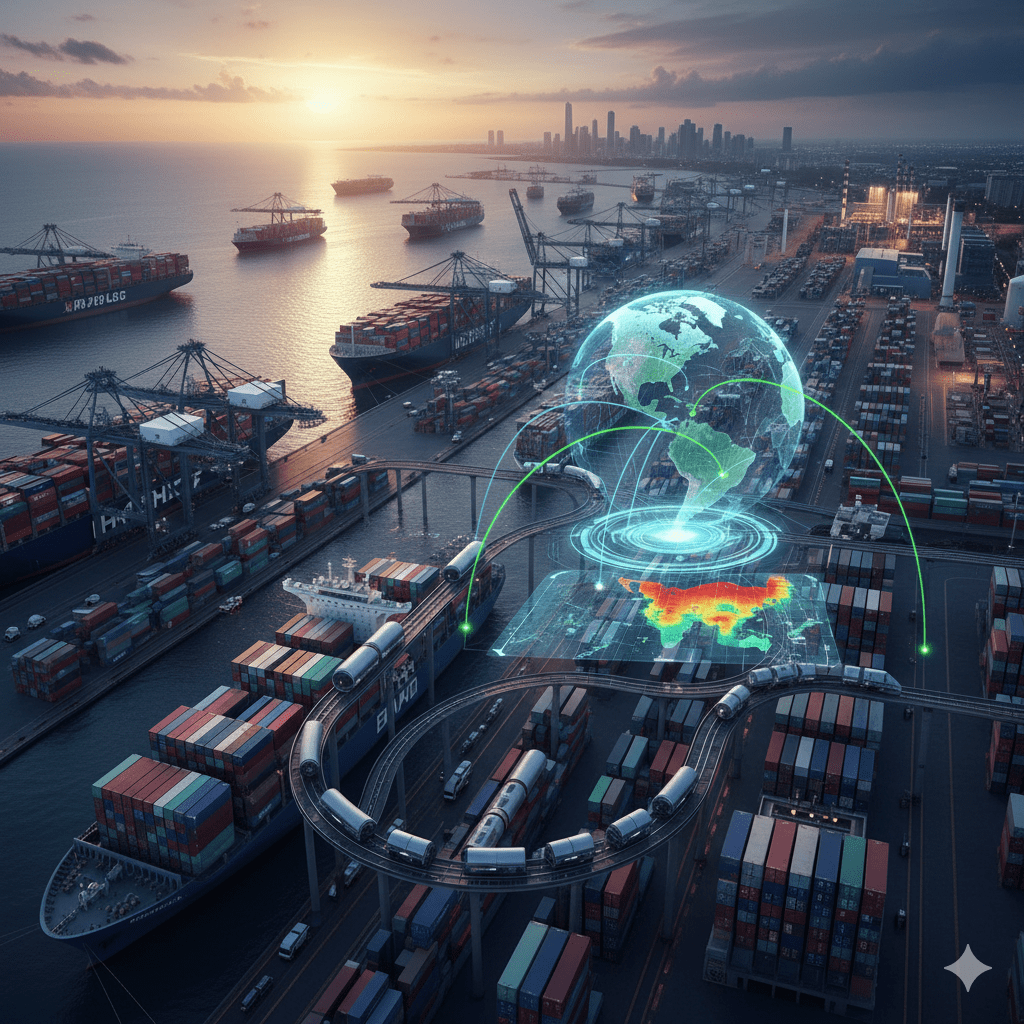

The global supply chain diversification strategy, fueled by geopolitical tensions and the evolving trade relationship between the United States and China, is triggering a tectonic shift in international commerce. Both Western and Asian corporations are migrating their manufacturing hubs to Southeast Asian nations—such as Vietnam, Thailand, and India. This phenomenon, widely known as the “China Plus One” strategy, is deeply intertwined with the nearshoring boom in Mexico.

This movement does not only affect maritime trade across the Pacific; it strategically positions Mexican West Coast ports—specifically Manzanillo and Lázaro Cárdenas—as essential transshipment hubs. These ports are now critical in rebalancing cargo that ultimately reaches the United States market via land, offering a resilient alternative to traditional logistics routes.

From a Simple Link to a Strategic Logistics Platform

Historically, Mexico’s logistical focus has been concentrated on the U.S. southern border. However, the surge of imports from Southeast Asia traveling through Mexico to reach American consumers is redefining the role of Mexican ports. They are no longer just national gateways; they are North American assets.

The Rise of Non-Chinese Asian Volumes: Container volumes from countries like Vietnam and India are growing at double-digit rates. These shipments arrive at Manzanillo or Lázaro Cárdenas and undergo a process of deconsolidation. While some cargo feeds the new nearshoring plants in Northern Mexico and the Bajío region, a crucial portion is transloaded onto trucks for final delivery to the U.S. This serves as an efficient “safety valve” to bypass the chronic congestion often seen in Southern California ports like Los Angeles and Long Beach.

Infrastructure and Capacity Challenges: This growth exerts unprecedented pressure on container handling capacity, rail connectivity, and, most importantly, inland trucking availability. Bottlenecks at port exits, whether in storage yards or access roads, are becoming limiting factors. For the U.S. market, a delay in a Mexican port can ripple through the entire domestic supply chain.

The U.S. East Coast Factor: Recurring congestion in the Panama Canal due to droughts, combined with disruptions in the Red Sea, has made Mexican land routes connected to Pacific ports a more predictable alternative. Shippers are increasingly choosing to dock in Mexico and truck cargo north rather than risking the uncertainty of long-haul maritime routes to the U.S. East Coast.

The Critical Role of North American Ground Transportation

The success of this new logistical configuration depends entirely on the efficiency of ground transportation connecting the port to the U.S. border. The reliability of the 1,200-mile road corridor from Manzanillo to the Texas border is what allows this region to function as the “Pacific Logistics Platform” for North America.

Integrated Door-to-Door Solutions: Modern logistics requires fully integrated services that handle port customs clearance, intermodal transfers, and the final cross-border drayage. This demands high-level coordination between customs brokers, port terminals, and FTL/LTL carriers to ensure that cargo doesn’t sit idle.

Risk Mitigation in the Pacific-North Corridor: Security on the highways connecting the coast to the U.S. border is paramount. Investment in advanced GPS monitoring, secure transit routes, and certified escorts is a necessary operational cost. Ensuring the fluidity of high-value cargo through these corridors is vital for U.S. inventory stability.

Modern Fleet and Specialized Talent: The demand for trucks and drivers for port-to-border hauls has skyrocketed. Fleets must be modern to comply with environmental and safety standards, and drivers must be trained in USMCA (T-MEC) compliance and cross-border security protocols.

Future Outlook: Nearshoring and Multi-Axis Consolidation

The Pacific Rebalance is not an isolated event; it is the maritime counterpart to industrial nearshoring. Cargo from Asia feeds the factories relocating to the region, and the ground transportation infrastructure is the artery connecting these two worlds.

Companies that successfully optimize their port logistics—reducing terminal dwell times—and secure their ground transportation capacity will be the ones to fully capitalize on this megatrend. Mexico is consolidating its position not just as a manufacturing powerhouse, but as an indispensable transshipment node for the Western Hemisphere’s supply chain management.

At America’s Freight, we closely monitor volume trends at Pacific ports to anticipate demand and ensure that your cargo moves with maximum efficiency and security. Whether your freight is destined for regional distribution or a cross-border crossing, our integrated maritime and land solutions provide the reliability your supply chain needs.