By María José Gamba

The financial transactions of international trade are entering an era of radical digitalization. Historically, these transactions have been anchored in complex instruments like the Letter of Credit (LC). Now, businesses need faster, cheaper payments for cross-border freight. They also need to reduce costly banking intermediaries and mitigate risk.

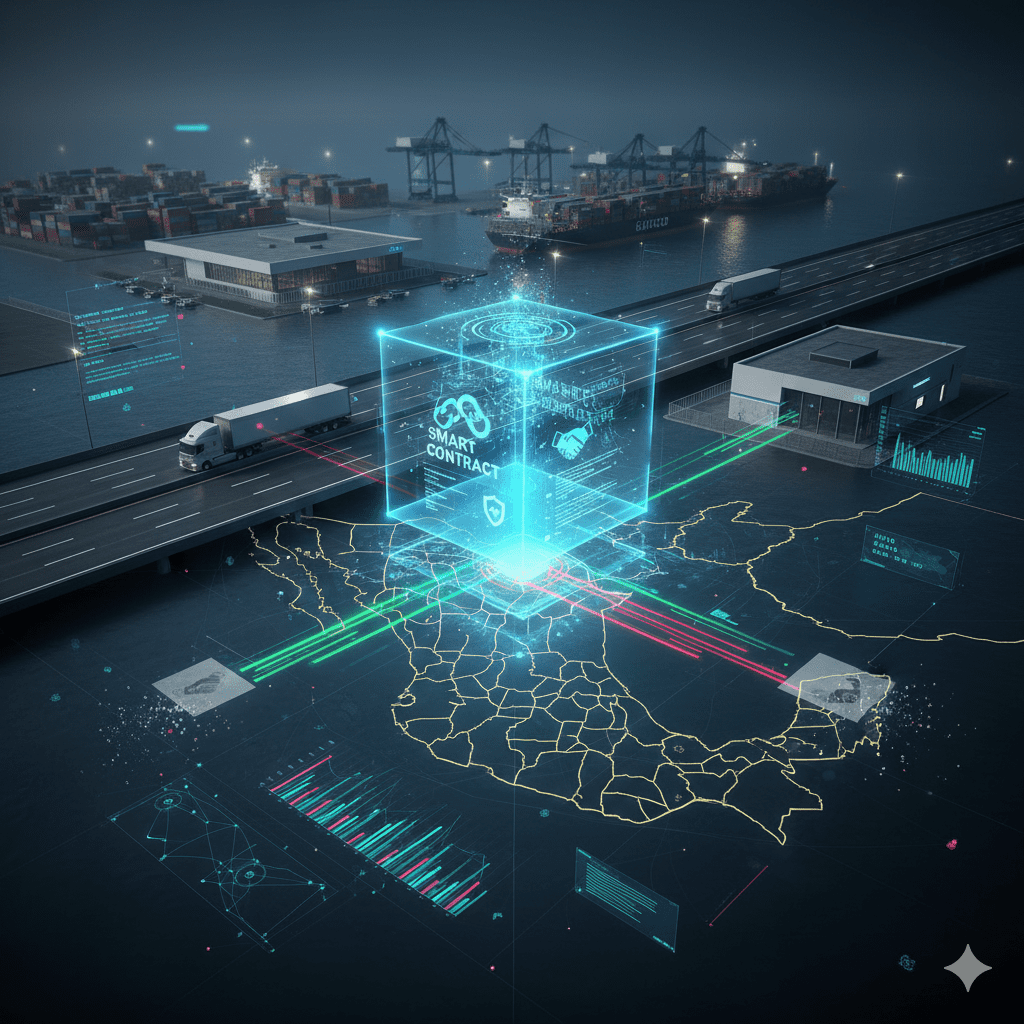

This demand has driven the adoption of blockchain technology. When combined with Smart Contracts, this distributed ledger offers a way to automate and make payment conditions for logistics services immutable. Logistics 4.0 is not just about moving cargo. It is about moving the money that backs the cargo instantly and securely.

The Problem of Trust and Payment Latency in Freight Settlements

Paying for international freight is notoriously slow, manual, and expensive in the current system.

Letters of Credit (LCs) and Associated Costs: LCs provide payment guarantees, yet they require the intervention of multiple banks. They also require the manual review of physical documents (Bills of Lading, manifests). Therefore, this process introduces friction and payment latency of days or even weeks. It also generates significant banking commissions, tying up valuable capital.

Risk of Disputes and Ambiguity: Carriers often experience delayed or disputed payments. This happens if the Proof of Delivery (POD) is ambiguous, lost, or subject to manipulation. Furthermore, the lack of a single, immutable source of truth erodes trust across the supply chain.

Working Capital Strain: Payment delays severely impact the carrier’s cash flow. Crucially, this forces carriers to rely on expensive financing tools like bank loans or factoring (invoice discounting). This adds overhead and reduces margins.

Smart Contracts: Event-Based, Automated Payments

A Smart Contract is a self-executing code stored on a blockchain. Consequently, payment does not require a manual intermediary (like a bank or an escrow agent). Instead, it is automatically triggered when predefined conditions are met. Significantly, secure external data feeds, called Oracles, verify these conditions.

Application in Ground Transportation:

Payment Activation by Milestones: Freight payment can be divided into verifiable milestones. For example:

The Smart Contract verifies via GPS data (the Oracle) that the truck has cleared U.S. Customs at the Port of Entry. Then, 30% of the payment is released.

The Smart Contract verifies the digital Proof of Delivery (e-POD) was uploaded, signed, and reconciled with the manifest. Additionally, the telematics tracker must confirm arrival at the final warehouse coordinates. Once these are confirmed, the remaining 70% is automatically released.

Reduction of Friction and Costs: The system eliminates manual verification steps and banking intermediaries. As a result, the transaction cost is drastically reduced. Payment is then processed in minutes or hours, not days.

Immutable Transparency: Blockchain records are immutable. Therefore, the potential for payment disputes is minimized. All supply chain participants (shipper, Freight Forwarder, carrier) access the same single source of truth regarding the delivery status.

Challenges for Adoption in North America

The widespread implementation of this technology requires overcoming several key obstacles.

Interoperability and Data Oracles: Carrier tracking systems, ELDs, and WMS must be able to securely “talk” to the blockchain. However, they must also act as trustworthy Oracles. This demands standardization across different logistics technology platforms.

Legal and Regulatory Clarity: In the blockchain world, “code is law.” Nevertheless, we need clarity regarding the legal validity and enforceability of a Smart Contract in U.S. and Mexican courts.

Digital Currency Stability: Most Smart Contracts settle using Stablecoins. This is because they are pegged 1:1 to the U.S. dollar, which mitigates financial volatility risk.

The digitalization of shipping documents was the first step. The digitalization of freight finance is the next frontier. Companies that adopt this technology gain efficiency. Moreover, they offer their carriers a key competitive advantage: payment certainty and immediacy.

At America’s Freight Forwarding, we are actively exploring decentralized technology payment solutions. This ensures the liquidity of our partners and the agility of our cross-border operations. Modernize your payments; modernize your logistics.